Ever tried to rent an apartment, apply for a loan, or even get a new phone plan—only to hear, “We’ll just need to run a credit check”? That moment can be nerve-wracking, especially if you’re not even sure what your credit score really means or how it differs from credit reports. You’re not alone.

Whether you’re a young adult just starting out, a small business owner eyeing a loan, or someone bouncing back from a few financial missteps, understanding your credit score is one of the smartest money moves you can make.

Let’s break it down—clearly, simply, and with zero judgment.

What Is a Credit Score?

Your credit score is a three-digit number that tells lenders how trustworthy you are with borrowed money. Think of it like a financial GPA based on your past credit behavior.

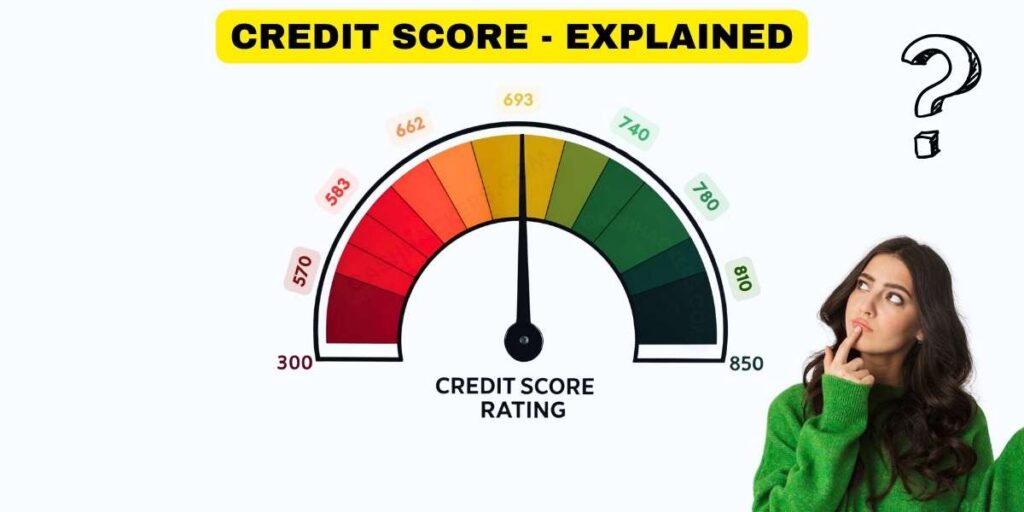

Most scores range from 300 to 850. The higher your number, the better your chances of getting approved for things like loans, credit cards, and even rental applications.

The Breakdown Behind the Number

Your credit score is typically calculated using:

- Payment history (35%) – Do you pay your bills on time?

- Credit utilization (30%) – How much of your available credit are you using?

- Length of credit history (15%) – How long have you had credit?

- Credit mix (10%) – Do you use different types of credit (like credit cards, loans)?

- New credit (10%) – Have you recently applied for new accounts?

Why Your Credit Score Matters

A good credit score can save you thousands of dollars over your lifetime. It can be the difference between getting a low interest rate or a rejection letter.

| Score Range | Category |

|---|---|

| 300–579 | Poor |

| 580–669 | Fair |

| 670–739 | Good |

| 740–799 | Very Good |

| 800–850 | Exceptional |

Real-World Examples:

- Buying a car? A higher score = lower interest rates.

- Starting a business? Lenders look at your personal credit score before approving business loans.

- Apartment hunting? Landlords check your credit history to see if you’re a reliable tenant.

How to Check Your Credit Score

You’re entitled to one free credit report annually from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Go to AnnualCreditReport.com to get yours without paying a dime.

Many credit card companies also let you check your credit score for free—so log into your online account and take a look.

What If You Have Bad Credit?

Don’t panic. Bad credit isn’t forever. Whether it’s due to missed payments, high balances, or just a short credit history, there are ways to rebuild:

Steps to Repair Your Credit Score:

- Pay all bills on time, every time.

- Keep your credit card balances low.

- Don’t open too many new accounts at once.

- Consider a secured credit card or a credit builder loan to rebuild responsibly.

- Dispute any errors you find in your credit report.

Pro Tip for Small Business Owners

If you’re applying for a small business loan, your credit score may still play a big role, especially if your business is new. Building a strong personal credit history can give your business a leg up in getting funding.

Final Thoughts: Credit Isn’t Complicated—It’s Just Not Taught Well

Your score isn’t just a number—it’s a reflection of your financial habits. The good news? You’re in control of it. The more you understand how it works, the better choices you can make.

Want to Learn More?

We’ve got a library of credit tips, credit-building hacks, and real-world guides to help you feel confident with money.

[Read more articles on Credit Scores here →]